Guide on Sterling Bank Car Loan Monthly Amortization

STERLING BANK CAR LOAN – Here is a guide on how much you must pay for every month under this loan offer of the Sterling Bank of Asia.

Are you planning to get a car soon? You have two options – to do it in a one-time full payment or through monthly amortizations. In the case of the latter, it can happen under loans.

Several banks and lending companies in the Philippines have auto loan offers. One of them is the Sterling Bank of Asia.

Sterling Bank has opened its offer to both brand new and second-hand or pre-owned vehicles. Its offer features fast loan application processing, flexible loan terms, and easy payment modes.

Do you want to check on the eligibility requirements in applying for this loan offer? Feel free to visit – Sterling Bank Auto Loan – Who Are Qualified To Apply For It?.

The loanable amount from this loan offer is from Php 100,000.00 and up. The loan term depends on whether you are getting a brand new vehicle or a second-hand one.

- 12 to 60 mos. (Brand New)

- 12 to 48 mos. (Second Hand)

According to the bank, the payment can be done through post-dated checks or automatic debit arrangement. You can check your possible loan amortization even prior to applying for the loan.

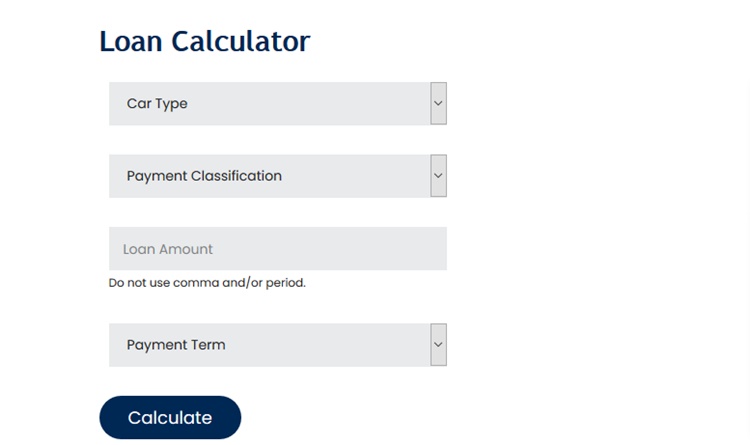

To check on your possible Sterling Bank Car Loan monthly payment, you may visit – www.sterlingbankasia.com. Be sure to prepare the following information:

- Car Type

- Payment Classification

- Loan Amount

- Payment Term

Thank you for visiting our website. We hope we have helped you with regards to this matter. You may keep coming back for more informative guides.

READ ALSO: STERLING BANK PERSONAL LOANS – Full List of Personal Loan Offers

I credit a loan for my store.pls approve my loan.