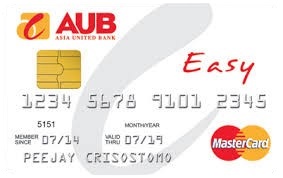

Guide on AUB Easy Mastercard Features & Requirements for Credit Card Application

AUB EASY MASTERCARD – You can check here the features and the requirements in applying for the Asia United Bank credit card offer.

In the Philippines, there are several credit card providers which include the reputable banks in the country. One of the trusted entities with the said type of offer is the Asia United Bank or more popularly called AUB.

The Asia United Bank is a universal bank that is operating in the country for decades now since 1997. It is the banking arm of the Republic Biscuit Organization. It has several offers including the different types of bank accounts, credit cards, loans, and a lot more.

The Asia United Bank offers different kinds of Mastercard. One of the excellent offers of the reputable banking industry is the AUB Easy Mastercard offer. It has the following features and benefits:

- choose how many times you pay every month (once, twice, or every week)

- choose your own due date

- choose how much you will pay depending on your budget or the amount that you can afford from the fixed payments set by the bank

- For once a month payments, choose from the following amounts:

- Php 750

- Php 800

- Php 1,000

- Php 1,500

- Php 2,000

- Php 2,500

- Php 3,000

- For twice a month payments, choose from the following amounts:

- Php 500

- Php 1,000

- Php 1,500

- For weekly payments, choose from the following amounts:

- Php 250

- Php 500

- Php 750

- For once a month payments, choose from the following amounts:

- waived annual membership fee for life

- no interest on new purchases

- earn one (1) Rewards Point for every Php 50 spend using your AUB Mastercard

- enjoy free flights and service class upgrades on Philippine Airlines

- online banking convenience

- access to complimentary airport lounge

- convenient payments with over 5,000 payment center nationwide where you can pay your bills through

- make online payment easier by linking your card to your PayPal account

- secured online shopping with Mastercard SecureCode

What are the qualifications in applying for the AUB Easy Mastercard offer? Just like in other credit card applications, there are eligibility requirements that a credit card applicant must meet to qualify to the offer. Here are the eligibility requirements under the offer:

- between 21 to 65 years old

- earning a gross monthly income of at least Php 50,000

- gainfully employed or self-employed

- If employed, applicant must be on regular status with a registered Company/Corporation for at least one (1) year.

- If self-employed, applicant must be in a registered business, operating profitably for at least one (1) year.

- If a licensed professional, the applicant must be practicing for at least one (1) year.

- must have a mobile phone and an office landline

- must have an active email address

The credit card offer is open for both employed and self-employed applicants. The bank has set varying requirements among the employed and self-employed credit card applicants.

Here is a guide on the documents that you need to prepare to apply for the AUB Easy Mastercard offer:

For Employed Applicants

- completed and signed AUB Credit Card Application Form

- copy of any government issued ID with photo OR employment ID

- copy of Statement of account for Postpaid Mobile Subscription

- proof of income (any of the following):

- Latest ITR (Form 2316)

- Certificate of Employment/Compensation

- Latest one (1) month payslip

For Self-Employed Applicants

- completed and signed AUB Credit Card Application Form

- copy of any government issued ID with photo OR employment ID

- copy of Statement of account for Postpaid Mobile Subscription

- proof of income:

- ITR (Form 1701, 1701Q)

- Latest Financial Statements and

- DTI Registration (preferably under the card applicant’s name)