Details about the BPI Savings Account “#SaveUp”

BPI SAVINGS ACCOUNT #SAVEUP – Here is a guide for the clients of the Bank of the Philippine Islands on its features and benefits.

Are you looking for an account that can give your savings additional interest? You may turn to the Bank of the Philippine Islands, more popularly called BPI. It is one of the biggest and most trusted banks in the country.

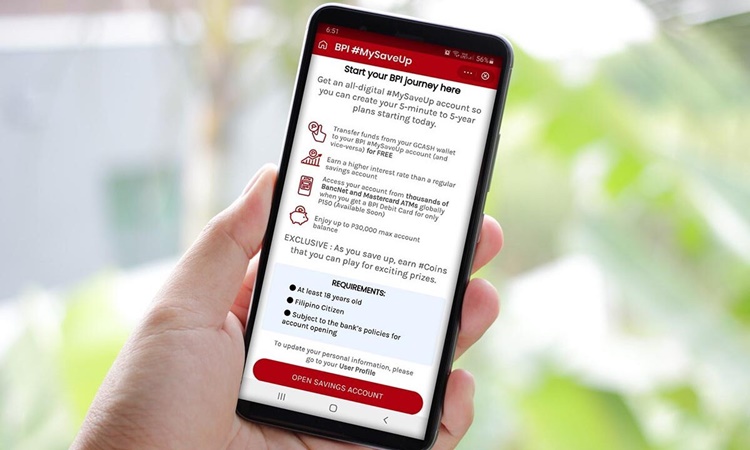

Aside from the BPI Regular Savings Account and the BPI Savings Account “Saver Plus”, the Bank of the Philippine Islands also offer the “#SaveUp”. It is an all-digital savings account that allows the account-holders to do and earn more.

Here are the features of the Maxi-Saver savings account of the Bank of the Philippine Islands:

- Required Initial Deposit — Php 1

- Required minimum monthly ADB — Php 0

- Required daily balance to earn interest — Php 5,000

- Interest rate per annum — Php 0.0925%

Higher interest. This BPI savings account brings a higher interest compared to the interest under a regular savings account.

Virtual prepaid card. This type of account comes with a virtual prepaid card for your e-commerce purchases.

Flexible account balance. Php 30,000 is the initial account limit which will be automatically waived after the verification.

#SaveUp Debit Card. You can access your account at any Mastercard or Bancnet affiliated ATM not only in the Philippines but as well as abroad when you get a BPI Debit Mastercard for only Php 200.00

In opening this type of BPI account, the process is different. Here are the steps in opening an account:

1. Select “Open a New Account”.

2. Tap “Create a bank account”.

3. Confirm your nationality.

4. Read and confirm our privacy statement.

5. Enter your mobile number and email address.

6. Enter the One-Time PIN.

7. Take note that the only available product is the #SaveUp digital product.

8. Read and agree to the terms and conditions.

9. Fill in the required information.

10. Select from BPI’s list of accepted IDs

11. Scan your ID. Make sure that the image is clear before proceeding.

12. Take a selfie to verify your identity.

13. Fill in the additional details.

14. Review your application and tap on “Confirm”.

15. Create your username and password.

Aside from savings accounts, the Bank of the Philippine Islands (BPI) also offer loans. These offers are open for both locally-employed and self-employed individuals. Here are the loans offered by the bank: