Guide on BPI Signature Credit Card Features & the Requirements for Application

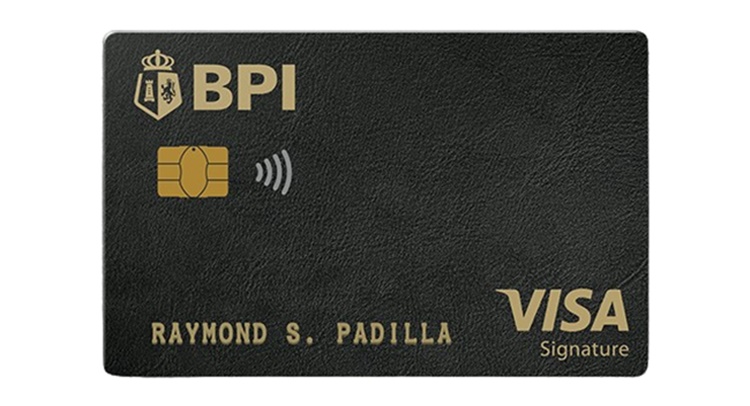

BPI SIGNATURE CREDIT CARD – Here is an overview of the credit card offer of the Bank of the Philippine Islands and its features and benefits for the cardholders.

Credit cards are among the best finance products and services that you can avail from banks. In the country, one of the credit card-providing entities is the Bank of the Philippine Islands or more popularly called BPI.

The Bank of the Philippine Islands or BPI is one of the reputable banking entities in the country. It is serving millions of Filipinos for decades now with its variety of finance products and services.

BPI got loan offers which include the BPI Seafarer Cash Loan and the BPI Personal Cash Loan. The bank also got multiple credit card offers that are packed with excellent features and benefits for the cardholders.

Aside from the BPI Rewards Credit Card, the Bank of the Philippine Islands also offer the BPI Signature credit card.

Are you interested to know the features and benefits for the cardholders of the BPI Signature credit card offer? Here are the features and benefits that the credit card was designed with:

- earn 2 BPI Rewards Points for every Php 20 spend using the card

- up to Php 20 million free travel accident and inconvenience benefits via air, land, or water

- signature deals of up to 50% off on dining, resorts, hotels, wellness centers, and fitness studios “all year round”

- boost your experience when travelling through “Visa’s 24/7 Worldwide Concierge, Airport Meet & Greet Immigration Services, Airport Transfer Program, and Luxury Hotel Collection”

- lowest forex conversion rate of just 1.85% thus you can really save when you shop in other countries using the BPI Signature Card

- preferential exchange rates on a wide array of foreign currencies

- use your rewards points to redeem shopping credits, miles, or gift certificates from premium merchants

- access to complimentary airport lounge at PAGSS international lounges in NAIA 1 and NAIA 3 for you and one guest

Are you interested to apply for the credit card offer of the Bank of the Philippine Islands? The eligibility requirements of the bank require the applicant to be either a Filipino or a foreigner living in the Philippines who is at least 21 years old.

Furthermore, the bank requires the credit card applicant to have a business or residence contact number and must be residing or working within a 30 kilometers radius of a BPI or BPI Family Bank branch or provincial business center.

To apply for the BPI Signature credit card offer, there are documents that must be prepared and submitted to the bank. The requirements for application vary among the employed and self-employed applicants.

Also, there is a different list of requirements for the foreigner residents in the Philippines who want to apply for the BPI Signature credit card offer. Here is a guide on the documents required by the bank for application:

Employed

- duly-accomplished and signed BPI Credit Card Application Form

- proof of income:

- government-issued ID

- Certificate of Employment (COE)

- photocopy of latest Bureau of Internal Revenue (BIR) Form 2316

- latest payslips

Self-Employed

- duly-accomplished and signed BPI Credit Card Application Form

- proof of income:

- latest Audited Financial Statement (AFS) with the Bureau of Internal Revenue (BIR) or bank stamp

- government-issued ID

- latest Income Tax Return (ITR) with BIR or bank stamp

Foreigner Resident

- duly-accomplished and signed BPI Credit Card Application Form

- passport

- Alien Certificate of Registration and work permit; or

- Embassy Accreditation papers