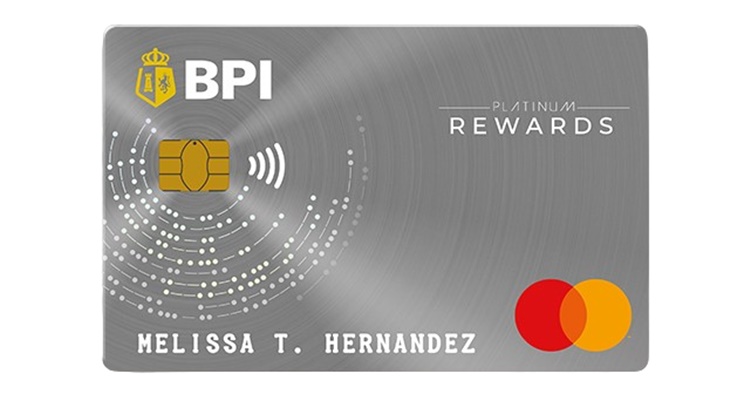

Guide on BPI Platinum Rewards Credit Card Features & the Requirements for Application

BPI PLATINUM REWARDS CREDIT CARD – Here are the best benefits that await the credit cardholders of the Bank of the Philippine Islands.

Are you looking for a credit card that can greatly help you in your finances wherever you are? In the Philippines, one of the entities that you can turn to for credit cards is the Bank of the Philippine Islands or more popularly called BPI.

BPI is one of the trusted and most reputable banks in the Philippines. It is in the service of the Filipino people for several decades now since 1851. The bank has several offers including savings and checking accounts, credit cards, loans, and a lot more.

The loan offers of the trusted bank include the BPI Personal Cash Loan and the BPI Car Loan. The bank also got multiple credit card offers. Aside from the BPI Rewards Credit Card, the bank also got the BPI Platinum Rewards credit card offer.

The BPI Platinum Rewards credit card got excellent features and several benefits for the cardholders. Here is a list of what awaits the credit cardholders of this type of bank offer:

- 0% installment on airline tickets for up to six (6) months when you book using your credit card

- access to more than 1,300 airpourt lounges around the world worldwide with a complimentary Priority Pass membership and get up to 4 free lounge passes every year

- up to 180 days of protection for your purchases against accidental damage and being stolen under the Mastercard’s Purchase Protection Insurance

- Free travel insurance of up to Php 10 million when booking a travel using your BPI Platinum Rewards Card

- earn two (2) BPI points for every Php 30 local spend or Php 20 foreign transaction online and abroad

- non-expiring rewards points with a wide selection of rewards to choose from

- priority lane at 24-hour BPI Contact Center and 24/7 assistance with Mastercard® Travel & Lifestyle Services

In applying for the loan offer, there are only a few qualifications that a credit card applicant should meet. The credit card offers of the bank are open for Filipinos or foreigners living in the country who are 21 years old and above.

A credit card applicant must have a business or residence number and must be residing or working within a 30 kilometers radius of a BPI or BPI Family Bank branch or provincial business center to qualify for the offer.

The BPI Platinum Rewards credit card offer is open not only for the salaried and non-salaried individuals but as well as foreigner residents in the country. The bank has set different lists of requirements among the credit card applicants.

Here is a guide on the documents required by the Bank of the Philippine Islands in applying for the BPI Platinum Rewards credit card offer:

Employed

- duly-accomplished and signed BPI Credit Card Application Form

- proof of income:

- government-issued ID

- Certificate of Employment (COE)

- photocopy of latest Bureau of Internal Revenue (BIR) Form 2316

- latest payslips

Self-Employed

- duly-accomplished and signed BPI Credit Card Application Form

- proof of income:

- latest Audited Financial Statement (AFS) with the Bureau of Internal Revenue (BIR) or bank stamp

- government-issued ID

- latest Income Tax Return (ITR) with BIR or bank stamp

Foreigner Resident

- duly-accomplished and signed BPI Credit Card Application Form

- passport

- Alien Certificate of Registration and work permit; or

- Embassy Accreditation papers