Guide on BPI Rewards Credit Card Features & the Requirements for Application

BPI REWARDS CREDIT CARD – You can check here the features and requirements in applying for this offer of the Bank of the Philippine Islands.

A lot of individuals do not have just one credit card but multiple. It is because these cards have excellent features and benefits for cardholders who know how to use them right. The reality is contrary to the experience of some people who mismanaged the use of their credit cards.

In the country, one of the banking entities that you may turn to for a credit card offer is BPI or the Bank of the Philippine Islands. The bank has several offers like loans including the BPI Car Loan and the BPI Seafarer Cash Loan. It also has multiple credit card offers for qualified individuals.

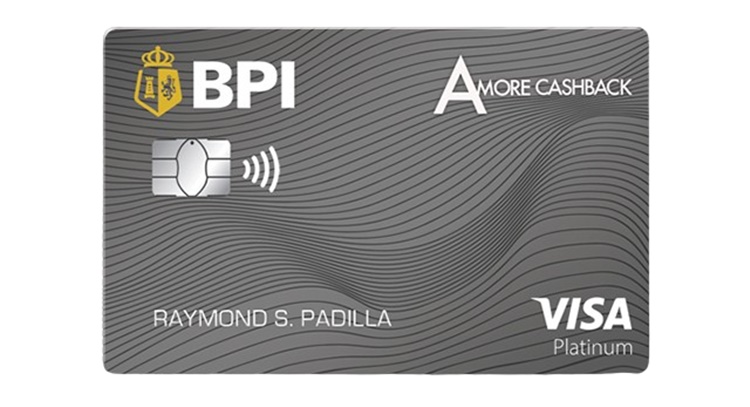

One of the credit card offers of the reputable banking entity in the Philippines is the BPI Amore Platinum Credit Card. It is packed with excellent features and benefits for the cardholders.

Do you want to know the features and benefits of the BPI Amore Platinum Credit Card? Here is a list of what awaits the cardholders of this type of finance product:

- 0.3% cashback on other local or international spend, in-store or online, for every Php 1,000 spend

- 4% cashback at restaurants for every Php 1,000 spend

- lowest forex conversion rates of just 1.85%

- access to cash by converting your credit limit to cash, it is payable for up to 36 months

- discount on your movie ticket purchase at cinemas

- 1% cashback when buying in supermarkets, department stores, and other shopping stores for every Php 1,000 spend

- unlimited access to Ayala Mall’s exclusive customer and family lounges and 5%

- multiple installment options

- 0% installment

- Buy Now Pay Later

- additonal installment limit with our Bonus Madness Limit

To qualify for the credit card offers of the Bank of the Philippine Islands, there are eligibility requirements that a credit card applicant must meet. Here are the qualifications in applying for the credit cards offered by the trusted banking entity:

- a Filipino or a foreigner living in the Philippines

- 21 years old and above

- with a a business or residence contact number

- residing or working within a 30 kilometers radius of a BPI or BPI Family Bank branch or provincial business center

How about the documents required by the Bank of the Philippine Islands in applying for the credit card offer? The credit card is open for both salaried and non-salaried individuals as well as foreigner residents.

The bank has set different requirements in applying for the BPI Amore Platinum Credit Card offer. Here is a guide on the documents required by the bank for the salaried and non-salaried individuals as well as foreigner residents in the country who want to apply for the offer:

Employed

- duly-accomplished and signed BPI Credit Card Application Form

- proof of income:

- government-issued ID

- Certificate of Employment (COE)

- photocopy of latest Bureau of Internal Revenue (BIR) Form 2316

- latest payslips

Self-Employed

- duly-accomplished and signed BPI Credit Card Application Form

- proof of income:

- latest Audited Financial Statement (AFS) with the Bureau of Internal Revenue (BIR) or bank stamp

- government-issued ID

- latest Income Tax Return (ITR) with BIR or bank stamp

Foreigner Resident

- duly-accomplished and signed BPI Credit Card Application Form

- passport

- Alien Certificate of Registration and work permit; or

- Embassy Accreditation papers