Guide on the EastWest Home Loan Interest Rates Under the Said Bank Offer

EASTWEST HOME LOAN INTEREST RATES – Here is a list of the interest rates implemented under the said EastWest Bank loan offer.

Buying a house and lot, a condominium unit, or a townhouse will require a huge amount of money. In fact, thousands and even millions may be needed in purchasing a vacant lot for residential purposes.

This is the reason why a lot of people have to go for loans. The loan offers are among the options so you can purchase your dream house and simply pay for it in installment basis based on your chosen loan term. These loans are usually provided by banks.

One of the banks with this offer is EastWest Bank. It is one of the giant banking companies in the Philippines and is formerly known as East West Banking Corporation.

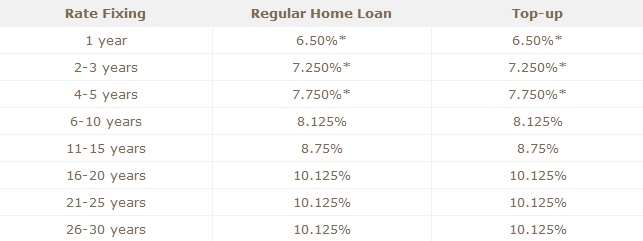

In choosing a loan offer, it is important to consider the interest rates. With regards to the EastWest Home Loan interest rates, the bank has provided it on its official website alongside with the fixing term under each rate:

The said EastWest Bank loan offer is open not only for the purchase of a residential property but as well as the funding of a house construction, a home renovation, and a home equity payment. You may also apply for it for the reimbursement of an existing housing loan.

Do you want to know how much you may borrow under it? You may visit – EASTWEST BANK HOME LOAN – How Much You Can Borrow Under It.

There is an organized process in applying for this EastWest Bank loan offer. Also, there are documents that you must prepare in applying. To check on the application process and the requirements, you may visit – EASTWEST BANK HOME LOAN – How To Apply & Requirements To Prepare.

Thank you for visiting our website. We hope we have helped you with regards to this matter. You may keep coming back for more informative guides.

READ ALSO: EastWest Bank Home Loan – How Long Is the Loan Approval Duration