Guide on Landbank Classic Credit Card Features & Application

LANDBANK CLASSIC CREDIT CARD – Here is a guide on the features and the requirements in applying for the credit card offer.

Contrary to how some people view it, a credit card has a lot of advantages for the credit cardholders as long as you know how to use it well. With the right amount of discipline and knowledge on when to use it, you can even earn through using the card.

In the Philippines, there are several credit card providers. Each credit card offer has a unique set of features thus it is important to check on them. One of the banks with credit card offers is the Land Bank of the Philippines.

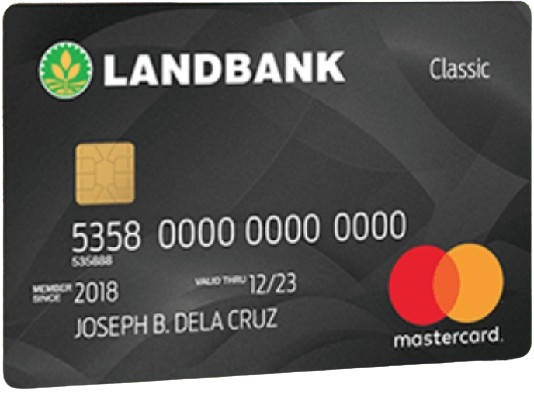

The photo posted above shows the Landbank Classic Credit Card. It has excellent features and privileges for the cardholders such as the following:

- access to cash advance of up to 30% of the credit limit

- lower interest rate at 3% per month

- enhanced credit card security features through the EMV Technology for safer customer and card information

- global acceptance among over 30 million Mastercard-accepting merchants locally and internationally

- convenience billing system through the Electronic Statement of Account (eSOA)

- Purchase E-mail Alert that sends you alerts through your nominated e-mail address notifying you for every purchase made using your Landbank credit card

- Easy Pay/ Equal Monthly Installment (EMI) – Add-on rate at 1%

- 24 Hour Lost Card Hotline

- 3D Secure One Time Password (OTP) for added security when shopping online

- earn one (1) Reward Point for every P50 spent online or via Point-Of-Sale (POS) terminals using your Landbank credit card

- Single Currency Billing

To qualify for the Landbank Classic Credit Card application, the applicant must be aged at least 21 years old but not more than 65 years old upon the credit card application and with a stable source of income. The bank requires a minimum annual income of Php 150,000. The credit card applicant must have no adverse findings on Credit Information checking.

With regards to the credit card fees, here is a guide on the charges set by the Land Bank of the Philippines under the credit card offer:

- Annual Membership Fee

- Principal Card — Php 1,000.00

- Supplementary Card — Php 250.00

- Cash Advance Fee — 5% of amount withdrawn but not exceeding P200.00

- Foreign Exchange Conversion Rate — Based on prevailing Mastercard Foreign Currency Conversion Rate plus 2% Assessment and Service Fee

- Card Replacement Fee — Php 300.00 for each card

- Returned Check Fee — Php 500.00

- Sales Slip Retrieval Fee — Php 350.00

- Statement Printing/ Reprinting Fee — Php 100.00

- Installment Pre-termination Fee — 5% of remaining balance or P300, whichever is higher

- Minimum Amount Due (MAD) — This is the sum of the following:

- 3% of Outstanding Balance (less Over Limit and/or Installment Amount, if any) or whichever is higher

- Installment Amount

- Overdue Amount

- Over Limit Amount

Aside from the Classic Credit Card, the government bank also offers the Landbank Gold credit card. In applying for the offer, there are requirements for the Landbank Credit Card application that must be prepared and submitted to the bank.