Tonik Bank Wants to Expand Its Services, Offers

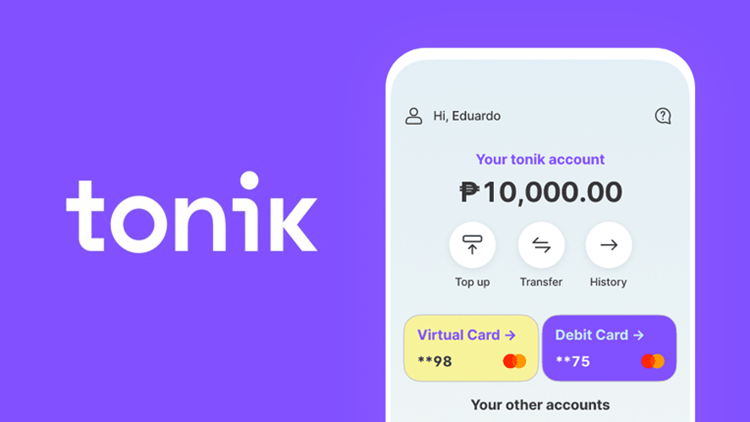

TONIK BANK – The digital bank is eyeing the expansion of its services and it wants to offer home loans and “Buy Now, Pay Later” services.

The COVID-19 pandemic has called on almost all fields to adjust. Even banking services which are among the essential services had to adjust to the situation. Several banks turned to a skeletal system with regards to their physical operation and encouraged their clients to utilize the online services as much as possible for their safety.

The economies of the Philippines and several other countries were greatly affected by the pandemic. Several businesses were forced to temporarily or permanently shut down following the huge losses. Many businesses most especially those that gather the crowd were not allowed to operate under strict community quarantine measures.

Meanwhile, there are also businesses that emerged or expanded amid the pandemic. Bangko Sentral ng Pilipinas have given licensed to several digital banks – including Tonik Bank.

The Central Bank previously said that digital banks can help in the recovery of the country’s economy. Many people will also surely benefit from their offers.

Tonik Bank is celebrating its first year in the country and it is eyeing an expansion of the services it offers. Based on a report on ABS-CBN News, Tonik Founder and CEO Greg Krasnov revealed that they will focus on widening their lending services.

Tonik Bank is eyeing the launch of cryptocurrency on its app amid high demands. Tonik Chief Product Officer Ed Joson said that they are already studying it. The digital bank is also planning to venture into the “Buy Now, Pay Later” services and offer home loans that can lend up to Php 2.5 million.

Joson stressed that they want to make loan applications for people faster and more convenient. They want things to be done “all digital'” in their app.

READ ALSO: Tonik Bank Cash Loan Offers Quick Money in as fast as 15 Minutes