Guide on Tonik Digital Bank Cash Loan Application Process

TONIK DIGITAL BANK CASH LOAN – Here is a guide on how to apply for this loan offer of Tonik Digital Bank including the requirements.

There are several different banks operating in the Philippines now. Some are banks that operate on physical structures while others are digital banks. Amid the COVID-19 pandemic, several banking companies applied for a license to operate as digital banks.

Digital banks pave the way for a wider scope of clients. It is effective most especially in times of pandemic when the mobility of people depends on the protocols set by the state. The applications for license were filed at Bangko Sentral ng Pilipinas (BSP) or the Central Bank of the Philippines.

BSP approved several applications for digital bank operation in the country. According to the Central Bank, they can help in the recovery of the country’s economy.

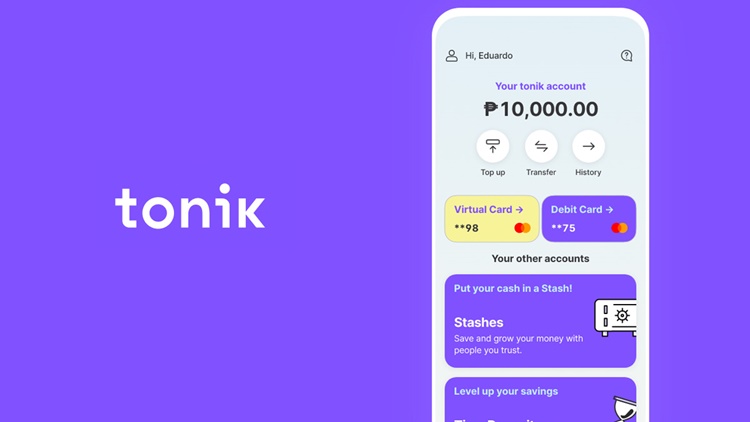

One of the digital banks that is operating in the Philippines now is Tonik Digital Bank. It has several offers to the public – savings accounts, cards, and loans. One of the loan offers is the Tonik Digital Bank Cash Loan.

Do you want to check the loanable amounts under the said offer? You may visit – Tonik Cash Loan: How Much You May Borrow under this Digital Bank Offer.

How To Apply for Tonik Digital Bank Cash Loan Offer

Step 1 – Check your eligibility in applying for the loan offer. To find out if you are qualified for it, you may visit – Tonik Bank Cash Loan: Who Are Qualified To Apply for this Loan Offer.

Step 2 – Prepare the requirements. There are documents needed in applying for this loan offer. To check on what you need to prepare, you may visit – Requirements for Tonik Cash Loan: What You Need to Prepare.

Step 3 – Download the Tonik App and register an account to apply for the loan online. You may download the app from Google Play or the App Store.

You may also visit – Tonik Bank Loan Interest Rate: Here’s a guide on the monthly rate