Guide on Tonik Digital Bank Virtual Debit Card – What It Can Offer You

TONIK DIGITAL BANK – Here are some details about the features and benefits of the virtual debit card offer of Tonik Bank

Nowadays, Filipinos have lots of options when it comes to banking activities. There are both physical and digital banks operating in the Philippines. The latter grew even more in number when the COVID-19 pandemic happened. Several banking companies applied for a license to operate a digital bank.

The license to operate a digital bank is obtained from Bangko Sentral ng Pilipinas (BSP) or the Central Bank of the Philippines. The BSP granted the application for license of several banking companies saying that these banks can also help in the recovery of the country’s economy from the pandemic.

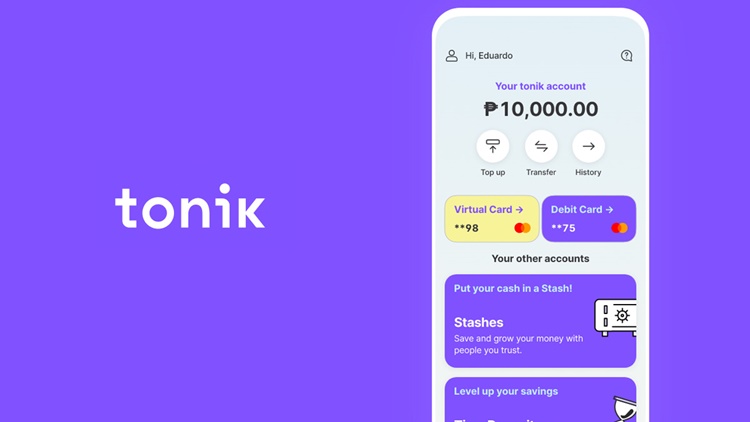

One of the digital banks that are operating in the country now is the Tonik Digital Bank. It has several offers to the public.

Tonik got savings account, debit card, and time deposit account offers and as well as loan offers. Do you want your purchases of essentials to be hassle-free? You might be interested in the Tonik Digital Bank Virtual Debit Card offer.

This card shuts down the chances of hackers as you can switch it off through the application. There is also no hassle in withdrawing your money as it can be done through any automated teller machine (ATM) nearest to you.

If you want a physical card of the Tonik Digital Bank Virtual Debit Card, you may make an order and just pay as low as P300.00 for a physical card. It is already inclusive of the production fee and the delivery fee for the card.

You might also be interested in the loan offer of the digital bank. Feel free to visit – Tonik Digital Bank Cash Loan: How To Apply for this Offer.