Guide on Tonik Quick Cash Loan – How Much You May Borrow

TONIK QUICK CASH LOAN – Here are the minimum and maximum loanable amounts under the Tonik digital bank cash loan offer.

In times of financial need, there are several entities now that people may turn to – these entities include lending companies and banks. There are several lending institutions across the globe and each of them has a different set of offers.

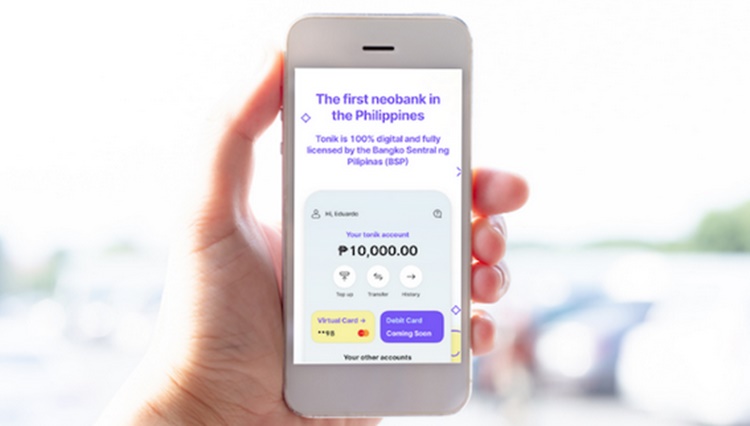

With regards to banks, there are a lot to choose from – physical banks and digital banks being among the major categories. Bangko Sentral ng Pilipinas (BSP) has approved several applications for a license to operate as a digital bank.

One of the digital banks operating in the Philippines now is Tonik digital bank. It has several offers to the public.

Tonik digital bank offers savings accounts and different kinds of cards including a debit card. It also has a special loan offer – the Tonik Quick Cash Loan. It is a multi-purpose loan offer that you can apply for to fund your travel expenses, purchase a gadget, finance a project, etc.

In applying for the said offer, there is no need for a credit history checking and as well as collateral. The bank guarantees fast approval and real-time release of the loan proceeds. How much you may borrow under Tonik Quick Cash Loan offer?

- Minimum Loanable Amount – P5,000.00

- Maximum Loanable Amount – P50,000.00

According to the digital bank, the amount borrowed can be paid in 6, 9, 12, 18, or 24 months. You may also choose your salary payout date. Do you want to apply for the said loan offer? For a guide on the application process, you may visit – Tonik Digital Bank Cash Loan: How To Apply for this Offer.

You may also visit – TONIK STASH: How It Works & How Your Money Can Grow