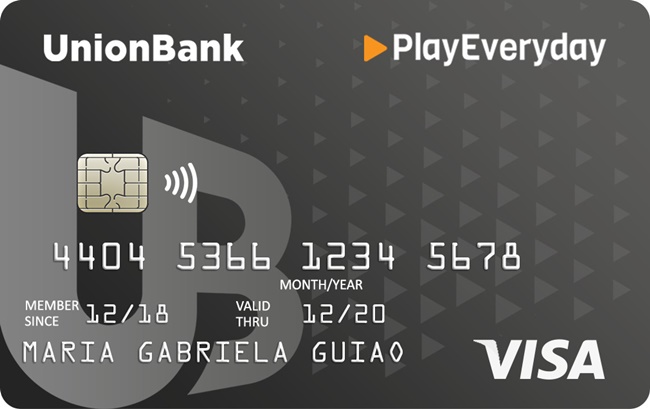

Guide on UnionBank Credit Card PlayEveryday Features & Application Process

UNIONBANK CREDIT CARD PLAYEVERYDAY – Here is a guide on the unique credit card offer of UnionBank with gamified banking rewards program.

Are you in search of a credit card with excellent features that will make a lot of things so much easier for you? You may turn to UnionBank, one of the most popular banking entities in the Philippines.

The UnionBank is one of the trusted banks in the country and it is operating in the Philippines for decades now. Its banking offers include both personal and corporate finance products like the UnionBank loans.

The UnionBank also has a credit card offer — the PlayEveryday. It is packed with excellent features and benefits for the cardholders such as the following:

- collect points which you can use to redeem items (P10 Visa spend = 1 play point)

- multiple ways to collect points:

- Setup your PlayEveryday profile = 500 points

- Setup your 2nd PlayEveryday card = 500 points

- Deposit at least P10,000 to your debit account = 100 points

- Referral = 300 points

- First Request for Payment = 50 points

- First Split Bill = 50 points

- Frist Scan QR Code = 50 points

- First 3 bills payment = 100 points

- Reach 100% of your goal = 300 points

- Reach 50% of your goal = 100 points

- rise up the ranks and join the leaderboards

- enjoy instant redeeming of rewards through UnionBank Online

- enjoy worldwide acceptable of your UnionBank Debit Card “PlayEveryday” with exclusive discounts and privileges

- be part of the first gamified banking rewards program

- bank 24/7 with UnionBank Online

- enjoy exclusive discounts and privileges

- have the option to split your expenses easily

- pay bills online anytime, anywhere

- enjoy seamless send and request of payments

Do you want to apply for the credit card offer? You need to prepare the requirements for the UnionBank Credit Card “PlayEveryday” application.