Step-by-Step Process for Pag-IBIG Short Term Loan Online Application

PAG-IBIG SHORT TERM LOAN – Here is a guide on how to apply for this cash loan offer of Pag-IBIG Fund online.

Nowadays, people can turn to several entities in times of financial emergencies. Some of these entities are private banks and lending companies while others are government agencies. Under the latter, one of them is Pag-IBIG Fund.

Many Filipinos are members of Pag-IBIG Fund. This government agency is mainly known for its housing loan offers. It aims to help Filipino families acquire their own residential property in an affordable way. The agency wants to assist most especially the minimum wage and the low-income earners.

To be eligible for the offers of the Pag-IBIG Fund, a member must have acquired the required number of contributions. The contributions or remitting of savings is done monthly.

Pag-IBIG Fund does not only offer housing loans but as well as cash loan – the Pag-IBIG Fund Short Term loan. It is a multi-purpose loan offer thus you may apply for it to buy a gadget, pay for the utility bills, fund an event, get the car repaired, etc. under a single loan.

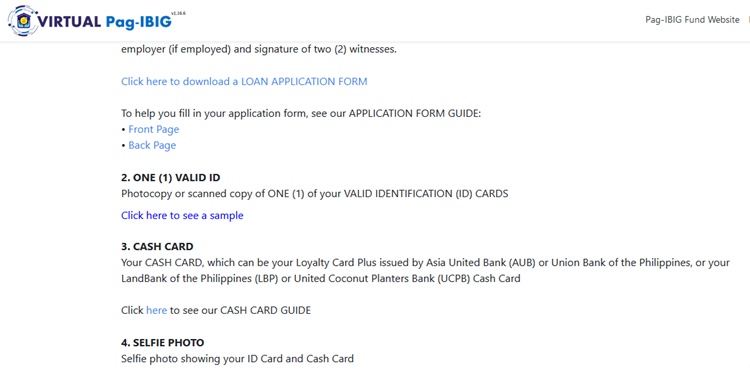

You may apply for Pag-IBIG Short Term Loan offer online. Before that, it is best to get the requirements prepared first. To check on the documents that you need to prepare and scan, you may visit – Requirements for Pag-IBIG Short Term Loan Online Application.

How To Apply Online?

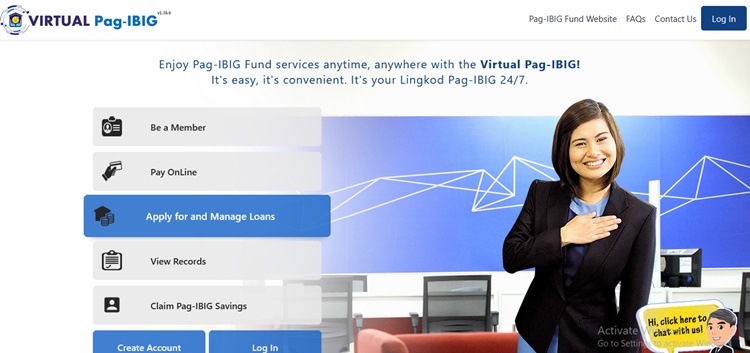

Step 1 – Visit the official website of Pag-IBIG Fund. Go to Virtual Pag-IBIG portion. Move your pointer to “Apply for and Manage Loans” and click it.

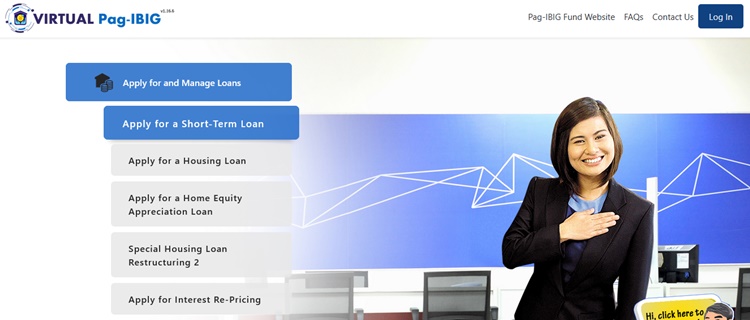

Step 2 – In the next panel, the loan offers of Pag-IBIG Fund will be displayed. Choose “Apply for a Short-Term Loan”.

Step 3 – Start your application.

You may also visit – PAG-IBIG FUND LOANS – Full List of Loans Offered By Pag-IBIG Fund

If ever po 5 years sa 2M magkno po

If ever po 5 years sa 2M magkno po at ung mabilis po at saan po dadalhin ung requirments