Ahead of 2025, SSS Speaks on Mandated Contribution Rate Hike

SSS – The Social Security System announced that it will push through with the increase of the members’ monthly contribution by January 2025.

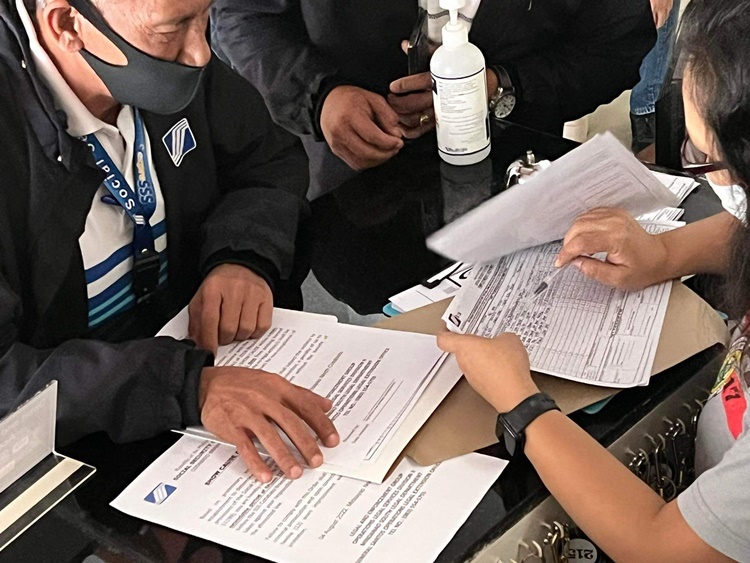

Millions of Filipinos are members of the Social Security System. To maintain an active membership to the social insurance giant for eligibility to the benefits and loan offers, a member must regularly post a monthly contribution.

The monthly contribution is dependent on the amount of the income of the member as well as the nature of the source of income. The social insurance giant membership is open to the following:

- local employees of the private companies

- self-employed individuals

- overseas Filipino workers (OFWs)

- non-working spouses of SSS members

- voluntary members

Millions of Filipinos have access to the different SSS loans that provide excellent financial solutions in different situations because of their membership. However, to maintain an updated membership to the state entity, another important thing is to check from time to time the effective contribution rates.

Recently, SSS senior vice president and chief actuary Edgar Cruz spoke on the monthly contribution rates for the members. Based on a report on Manila Standard, Cruz expressed that they will follow the rules which set an increase on the monthly contribution rates.

“As a system, we follow what the law says, the law says there’s scheduled increases. We will do that,” the Social Security System official said.

According to Cruz, the raise in the monthly contribution will not be one-sided as the members can also expect more benefits upon the retirement. He recalled that they made a presentation last year to Malacañang to defer the hike and the Palace listened.

Under the law, the Social Security System must gradually increase the SSS monthly contribution rate by 1% every two (2) years until it reaches 15% by 2025. Based on the report, the monthly contribution rate has increased to 14% by 2023 .

If the hike will be implemented, based on the report, the employer will shoulder the 1% on the monthly contribution of his/her employees which bring the monthly contribution to 9.5%. Out of the 15% monthly contribution, the 4.5% will be shouldered by the employee.