Guide on UnaCash Cash Loan Offer Online Application Process

UNACASH CASH LOAN – Here is a guide on the online application process for this multi-purpose online loan offer.

Individuals who live busy lives now have a way to avail loans without leaving their workplaces or breaking their schedules. There are online loans now that make it possibe for these people to obtain funds in a convenient and time-saving way.

Through online loans, you may apply for a loan anywhere you are as long as you have a stable internet connect and a mobile or computer. Most of the online lenders offer 24/7 services.

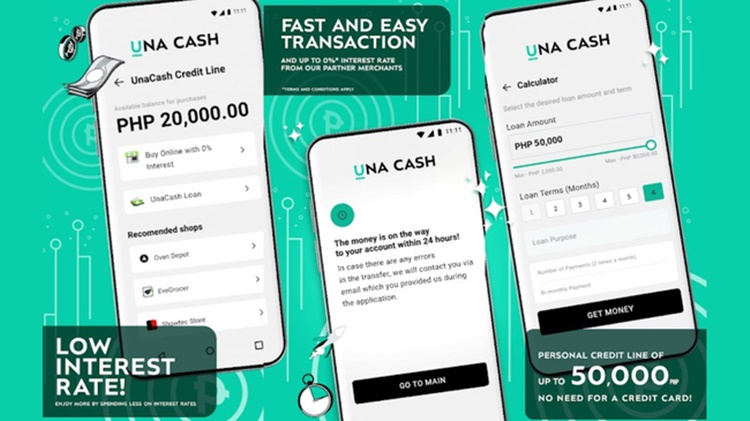

One of the most popular online lenders in the country is UnaCash. It offers convenient and seamless experience in loan application as well as competitive interest rates.

One of the factors that make UnaCash stand out from many other online loan offers is its high loanable amount. To check on the borrowing amounts allowed under the offer, you may visit — UnaCash Online Cash Loan – Minimum & Maximum Loanable Amounts You May Borrow.

The online lender takes pride in offering low interest rates, swift loan approval, and flexible repayment terms. You have the option to repay the loan over a period of up to six (6) monthly amortizations.

To apply for the UnaCash Cash Loan offer online, you must follow these steps:

- Step 1 – Download the UnaCash app and fill in your personal information.

- Step 2 – Select the loan terms.

- Step 3 – Wait for the approval.

- Step 4 – Get your money.

The online lender guarantees a maximum of a 24-hour loan approval time. You don’t need a bank account or a credit card to be eligible to apply for this online loan offer. For your convenience, you have the option to pay for the loan offer online through GCash or online bank transfers or offline through its partner stores:

- 7-11

- Bayad Center

- Cebuana Lhuillier

- M Lhuillier

- The SM Store

You may also visit – Online Loans: Here’s What You Need To Know & Some Tips in Managing your Loan Accounts.