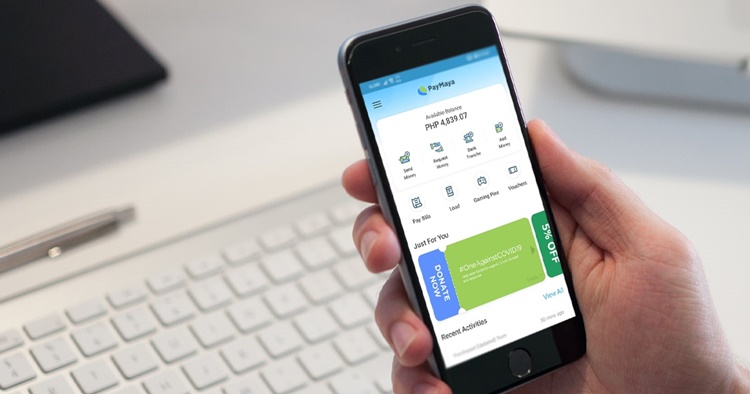

Guide on Paymaya Cash Loan Loanable Amount under Maya Credit

PAYMAYA CASH LOAN – Here is a guide on how much you may borrow under the Maya Credit loan offer of Maya Bank.

Are you looking for a digital bank where you may apply for a cash loan that can be used in multiple ways? There are countless offers online and the offers may differ in terms of the eligibility and documentary requirements, the mode of application, the loanable amounts, and the reputation of the lender.

In the Philippines, one of the most popular digital banks that you can turn to is the Maya Bank, the digital bank of the popular financial platform Paymaya.

The Paymaya Cash Loan is a credit line offered by the Maya Bank. The Maya Credit Loan is a short-term credit line that you can use in attending to emergencies, buying load, paying bills, and making online purchases. It is connected with over 700 billers and 360 merchants nationwide.

To qualify, the borrower must be:

- at least 21 years of age and not over 65 years old

- having an upgraded account

- actively using the account

- having a good credit standing

The Maya Credit works like a credit card. It is transferrable to your Maya Wallet or you can also do web checkout of your balance. You can use your credit line for multiple transactions as long as you have not used up all of your credit limit.

Under the said Paymaya cash loan offer Maya Credit, you can borrow at least P500 up to P15,000. The maximum loan term is 30 days. After the payment of your due, your credit limit replenishes.

To apply for the loan or credit line offer, you may visit – Maya Bank.

You may also visit — GCash Cash Loan: How To Apply & the Requirements / Qualifications