Guide on the Interest Rates Implemented Under the EastWest Bank Personal Loan

EASTWEST BANK PERSONAL LOAN – Here are the full and updated lists of the interest rates that EastWest Bank implements under its personal loan offer.

The EastWest Bank is one of the banks in the Philippines that have several loan offers for the public. These are cash assistance services provided to help clients make ends meet or reach their goal and pay for it in installment basis.

With regards to the loans offered by the private bank, there is the Personal Loan, the Home Loan, and the Auto Loan. If you are not into buying a house or car, you may apply for the personal loan offer which is a multi-purpose loan.

Based on the official website of the bank, the Personal Loan covers purposes of young adult up to those who are in their retirement age. You may apply for the said loan offer to:

- purchase a gadget

- buy car accessories

- fund your wedding

- travel

- fund your child’s education

- improve your home

- pay for the utility bills

- pay for your hospitalization

Under this loan offer, there is no need for a co-maker or a collateral in applying. Flexible terms are also offered – you may pay for your loan from twelve(12) to thirty-six(36) months.

- Minimum Loanable Amount – Php 25,000.00

- Maximum Loanable Amount – Php 2,000,000.00

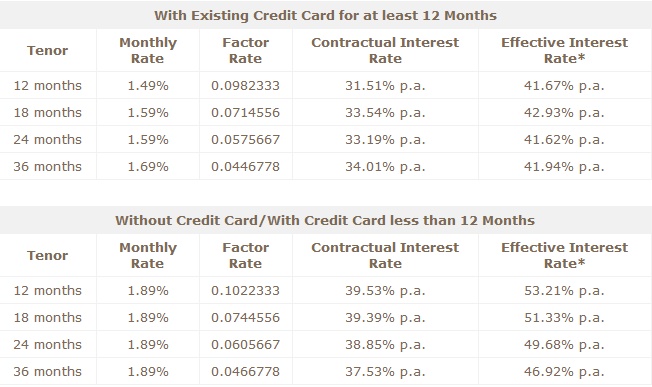

With regards to the interest rates implemented under the EastWest Bank Personal Loan, it will depend if you have a credit card or not. Here are the lists of the rates in courtesy of the bank:

Personal Loan Interest Rates

Do you want a guide on how to apply for it and the requirements needed? You may visit – EastWest Personal Loan – How To Apply & Requirements Needed.

Thank you for visiting our website. We hope we have helped you with regards to this matter. You may keep coming back for more informative guides.

READ ALSO: EASTWEST BANK LOANS – List of Loan Offers of EastWest Bank