How To Apply For BPI Personal Loan Online

APPLY BPI PERSONAL LOAN – Here is a guide on how to apply for the personal loan offer of the Bank of the Philippine Islands online.

The Bank of the Philippine Islands or more commonly called as BPI is one of the largest banks in the Philippines. It caters different services to the public including loans.

One of the BPI loans is the personal loan offer. A lot of people make an application for it as it can serve different purposes including the funding of a home renovation, a travel, paying for the school fees, etc.

According to the bank, this loan offer is unsecured or non-collateral. You do not need to present your property as a collateral and put it risk of being forfeited in case you cannot pay for your loan. Meanwhile, the bank assesses the capacity of the borrower carefully.

You have two options in case you want to apply for the BPI Personal Loan. One is you can do it personally while the other is you can do it online.

In this article, we will guide you on how to apply for the BPI Personal Loan online. Based on the official website of the bank, simple follow these steps:

Step 1 – Prepare your income documents and scan them.

Among the documents that you will have to prepare in applying for the personal loan offer online are your income documents. It should be scanned as it is needed to be sent through the email of the bank – [email protected].

Step 2 – Visit the official website of the bank – https://www.bpi.com.ph/.

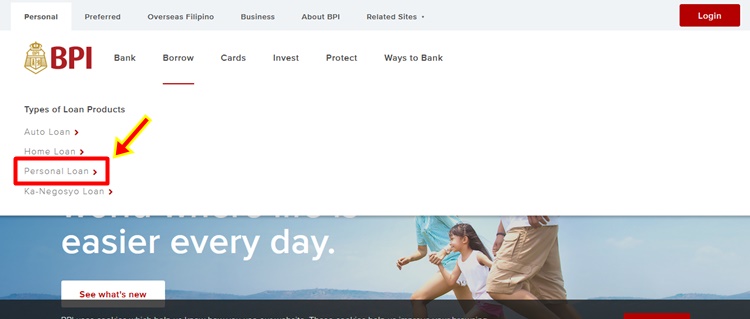

Step 3 – Move your cursor to ‘Borrow’ and click ‘Personal Loan’.

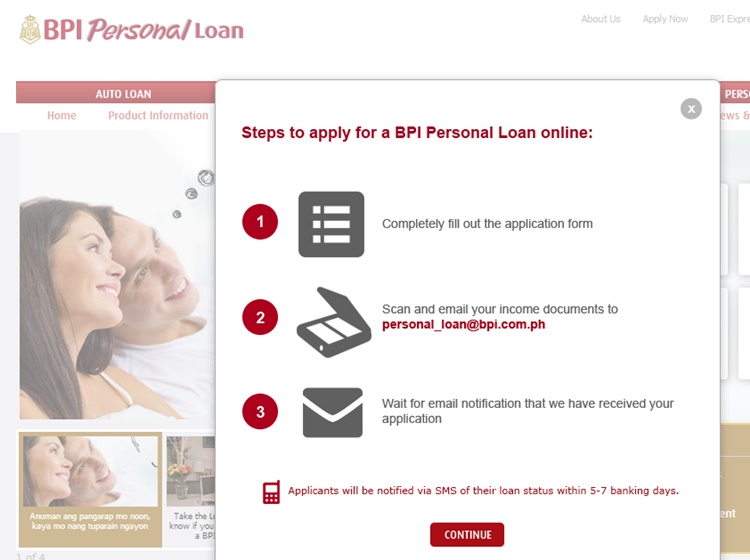

Step 4 – Click ‘APPLY NA!’. You will be presented with the flow on how to apply for the BPI Personal Loan online. It involves the filling in of the application form and the sending of your scanned income documents.

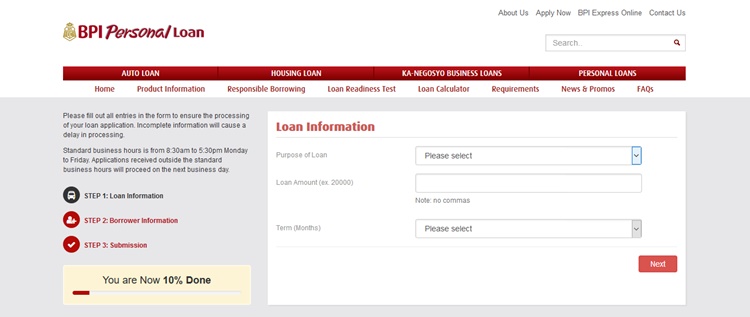

Step 5 – Provide the necessary information and continue the process.

According to BPI, the bank will notify the applicant within five(5) to seven(7) working days since the submission of the application regarding its status.

In case you want to do your application online, you may visit – BPI PERSONAL LOAN: How To Apply, Requirements In Applying.

Thank you for visiting our website. We hope we have helped you with regards to this matter. You may keep coming back for more informative guides.

READ ALSO: BPI PERSONAL LOAN AMOUNT: Maximum Loanable Amount, Term

Good day Sir, I’m a former OFW, at present I’m on the process of setting up of my water station I’m in need of 250k to purchase the machinery,

Im ofw how to apply loan

How to apply

i own gen. merchandise store i need an additional capital can i apply for a personal loan in this institutiin.

may i hear from you soonest.

Thank you and more power.

magandang araw po magiinquire lang po kung puwedi po bang magloan ang ofw.

pede loan..how much interest.how much can barrowed?

iwant to apply personal loan

how to apply personal loan

online bank bpi

gusto q po mag apply ng personal loan 300k karagdagang capital po