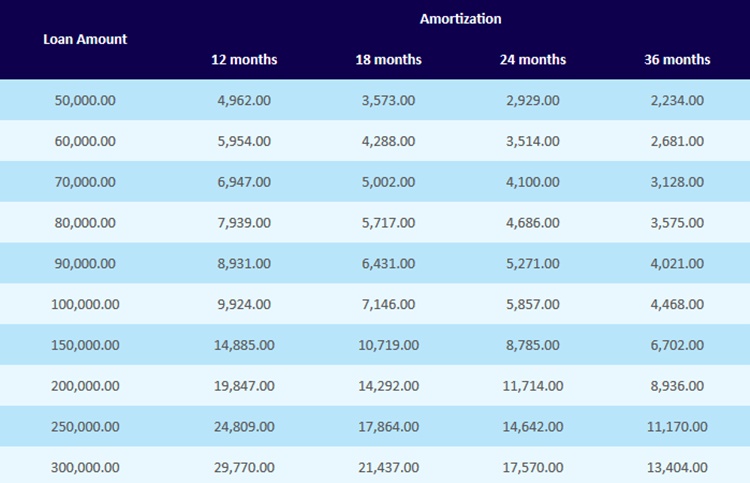

List of UCPB Cash Loan Monthly Amortization Based on Term and Amount of Loan

UCPB CASH LOAN – Here is a list of the monthly amortization for the cash loan offer of the United Coconut Planters Bank based on loan amount and term.

One of the prominent Philippine bank when it comes to accounts and loans is the United Coconut Planters Banks or more commonly called UCPB.

With regards to its loan offers, UCPB offers different kinds of loans that can address your needs. Among its offers include the car loan, home loan, and salary loan.

You may apply for the “SalarEasy” loan or the UCPB cash loan which offers flexible terms and loan amounts whether you are employed or self-employed.

Based on the official website of United Coconut Planters Bank, the following are the eligibility requirements for the UCPB Salary Loan:

- If you are a Filipino citizen and a permanent resident at least 23 years old or not more than 65 years old (70 years old if self-employed) upon maturity, and

- If you are a checking account holder and a major credit card holder, and

- If you have been a permanent employee for at least 2 years with supervisory rank and a minimum gross monthly income of P30,000.00, or

- If you have been self-employed with business operational for at least 3 years and profitable for the last 2 years

UCPB CASH LOAN: List of Monthly Amortization Based on Loan Amount and Terms

According to UCPB, the payment for the monthly amortization of the cash loan will be made through post-dated checks. Are you planning to apply for the said loan?

We’ll be updating you soon with a guide and the requirements that you need to prepare for the loan application.

Thank you for visiting our website. We hope we have helped you with regards to your possible monthly amortization to UCPB in case you will apply for its money loan. You may keep coming back for more informative guides.

cash loan