Guide on How To Apply for the UnionBank Auto Loan

UNIONBANK AUTO LOAN – Here is a guide on how to apply for UnionBank of the Philippines’ car loan offer to the public.

Are you aspiring to have your own car and enjoy the benefits of having your own vehicle now? There are already ways to do it even though you cannot pay for it in full as of this moment. Several banks including the UnionBank of the Philippines offer car loans.

The UnionBank Car Loan is another excellent loan offer of the bank aside from the UnionBank Salary Loan and the UnionBank Home Loan. It features car acquisition that fits the budget of the client.

Based on the official website of the bank, you can make your application for the UnionBank Auto Loan online and there are only a few easy steps to go.

Here is a guide on how to apply for the UnionBank Auto Loan online:

Step 1: Visit the official website of the UnionBank of the Philippines – https://www.unionbankph.com.

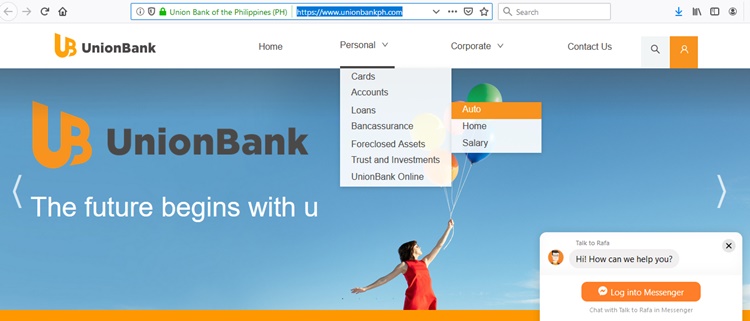

Step 2: Move your mouse pointer to “Personal” and then drag it to “Loans”. Click “Auto Loan”

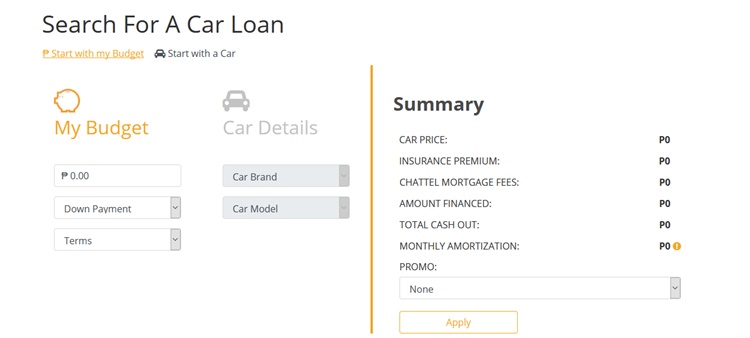

Step 3: The online application process will involve the calculation of your budget, the filing in of the required information about the vehicle and the client, and the submission.

Indicate your budget, your downpayment, and your preferred term. State as well as the brand and model of the vehicle you wish to purchase. Click “Apply” and proceed to the filling in of the application form.

After submitting your application, you will have to wait for the notice of the UnionBank regarding your application. Keep in mind that there are fees that you should be prepared of in applying for a car loan. With this bank, it includes the following:

- Chattel Mortgage Fees

- Insurance Premium

Thank you for visiting our website. We hope we have helped you with regards to this matter. You may keep coming back for more informative guides.

READ ALSO: UNIONBANK CREDIT CARDS – List of Credit Cards Offered by UnionBank