Steps on How To Get TIN Number for OFW & the Requirements

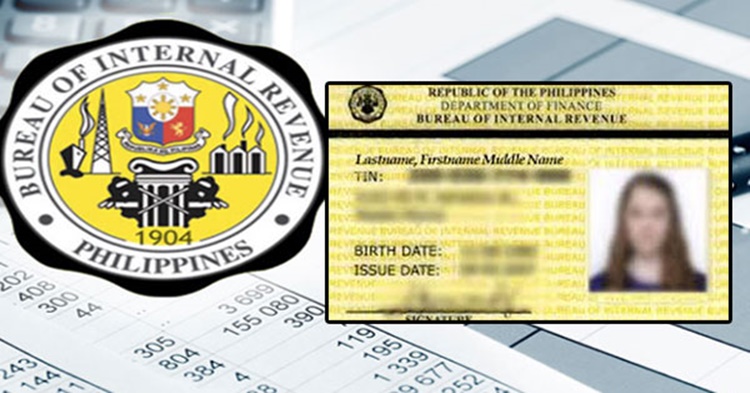

HOW TO GET TIN NUMBER FOR OFW – Here is a complete guide in getting a Tax Identification Number from the Bureau of Internal Revenue or BIR.

In the Philippines, one of the most important documents is a Tax Identification Number or more popularly called TIN. It is issued by the Bureau of Internal Revenue or BIR, the tax-collecting body in the country. This document certifies that an individual or a group is a taxpayer in the country.

The Tax Identification Number or also called TIN number although it is undeniably a redundant term is often required in many transactions including loan applications. It is also often asked from individuals who are earning money and wants to open a bank account.

Aside from bank account applications and loan applications, the Tax Identification Number is also often asked when making huge purchases like buying a house. The TIN is issued among the following categories:

- anyone who earns an income in the Philippines (Filipinos and foreign nationals)

- self-employed Filipino and foreign individuals including:

- freelancers

- sole proprietors

- online sellers

- professionals

- mixed-income earners

- local and foreign estates in the Philippines

- Filipino-owned and foreign-owned corporate tax payers in the Philippines

- persons registering under EO 98 to be able to transact with other government offices

- one-time taxpayers including the individuals who will be paying any of the following:

- capital gains tax

- donor’s tax

- estate tax

- tax on winnings

How to get a TIN number? The process may vary depending on the employment status or the source of income of the individual or group. In the case of overseas Filipino workers (OFWs), there is a unique set of TIN Number requirements that you must prepare in applying for the document.

Included in the set of requirements is the payment of the TIN number fee. Here are the steps on how to get a TIN number for OFW:

- Step 1 — Visit the RDO with jurisdiction over your residential address and tell the Burea of Internal Revenue (BIR) officer that you’ll be applying for a TIN under the Executive Order 98.

- Step 2 — Submit your requirements. Make sure to bring with you all the documents that the BIR requests from OFWs for the TIN issuance to avoid wasting money, time, and energy in going back and forth to the RDO.

- Step 3 — Wait for the processing of your Tax Identification Number by the BIR officer.

- Step 4 — Receive your copy of the BIR Form 1904 which contains your TIN.

Please note that the TIN applications for people registering under the Executive Order 98 must be filed before transacting with any government office.