Steps on How To Get TIN Number for Partnership & the Requirements

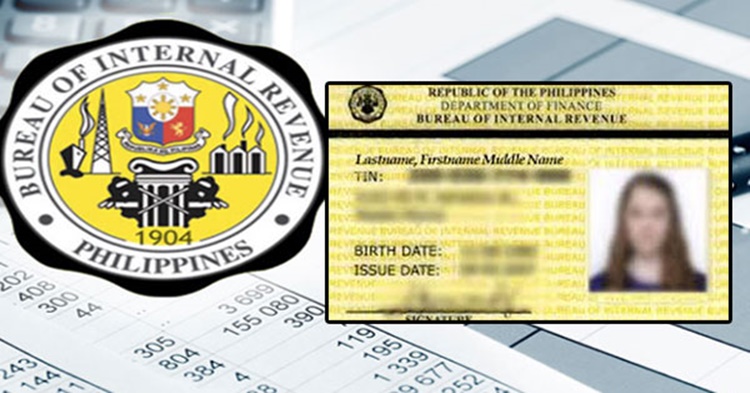

HOW TO GET TIN NUMBER FOR PARTNERSHIP – Here is a complete guide in getting a Tax Identification Number from the Bureau of Internal Revenue or BIR.

A lot of transactions in the Philippines require the TIN number or the Tax Identification Number. It is issued by the Bureau of Internal Revenue or more popularly called BIR, the tax-collecting body in the country.

The Tax Identification Number or TIN is a certification that proves that an individual or group is paying taxes to the government. It is usually required in applying for loans like the Pag-IBIG Housing Loan and the bank loans as well as in making huge purchases like buying a house.

More popularly called BIR, the Bureau of Internal Revenue issues the Tax Identification Number to many categories such as the following:

- anyone who earns an income in the Philippines (Filipinos and foreign nationals)

- self-employed Filipino and foreign individuals including:

- freelancers

- sole proprietors

- online sellers

- professionals

- mixed-income earners

- local and foreign estates in the Philippines

- Filipino-owned and foreign-owned corporate tax payers in the Philippines

- persons registering under EO 98 to be able to transact with other government offices

- one-time taxpayers including the individuals who will be paying any of the following:

- capital gains tax

- donor’s tax

- estate tax

- tax on winnings

How to get a TIN Number for a partnership? If you wish to apply for the Tax Identification Number, the TIN Number requirements that you need to prepare also depend on your source of income. You also need to prepare for an amount for the TIN number fee.

Here are the steps on how to get a TIN number for a partnership:

- Step 1 — Visit the RDO which has the jurisdiction over the location of the head office or branch office.

- Step 2 — Submit the documentary requirements to the New Business Registrant Counter (NBRC).

- Step 3 — Pay the BIR fees which will include the annual registration fee, the documentary stamp tax, and the payment for the BIR-printed receipt/invoice.

- Step 4 — Attend the scheduled initial briefing for new business registrations in the RDO.

- Step 5 — Receive the following documents from BIR:

- Certificate of Registration (BIR Form 2303)

- Notice to Issue Receipt/Invoice

- BIR-printed receipts/invoices or Authority to Print, whichever is applicable

- Received copy of BIR Form 1901

- Proof of payments

Partnerships must get a TIN number on or before the start of the business or whichever comes first between the day when the first sale was made or within 30 calendar days from the date that the Business Permit was issued, or before the payment of any tax due.