Details about the SSS Salary Loan Payment Schedule for Employed Borrowers

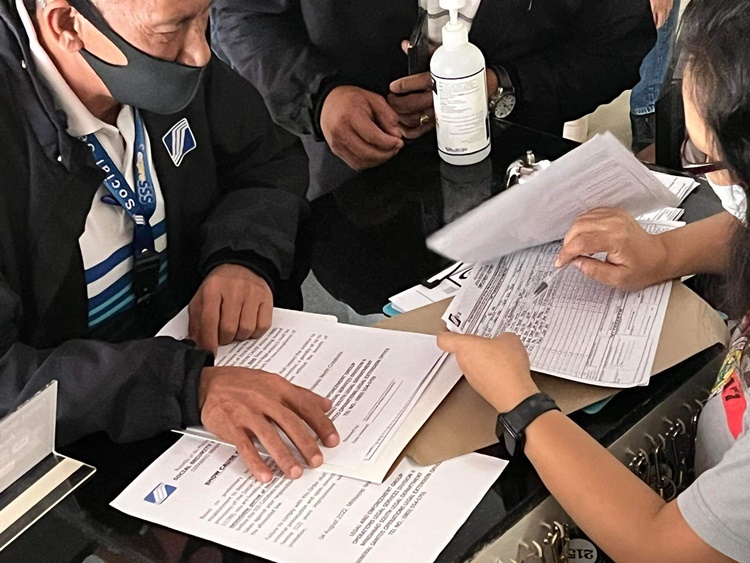

SSS SALARY LOAN PAYMENT SCHEDULE – Here is a guide on the deadline for the payments of employed member-borrowers under the cash loan offer of the Social Security System.

More popularly called SSS, the state-run social insurance institution Social Security System has several loan offers for its members. Those members who have posted at least 36 monthly contributions may apply for its Salary Loan offer.

The cash loan offer of SSS is non-collateral. It is also payable for up to 24 months or two (2) years. To borrow money under the said offer, the following documents are needed:

- duly-accomplished Member Loan Application Form

- SSS digitized ID or E-6 with any two (2) valid IDs (one of which with a recent photo)

- Postal ID

- Baptismal Certificate

- Tax Identification Number (TIN) Card

- Senior Citizens Card

- School ID

- Professional Regulation Commission (PRC) ID

- LTO Driver’s License

- Credit Card

- Health or Medical Card

- GSIS Card

- Seaman’s Book

- Company ID

- Voter’s Identification card/affidavit/Certificate of Registration

- ATM card with cardholder’s name or with certification from bank

- NBI Clearance

- Transcript of Records

- Certificate from:

- Office of Muslim Affairs

- Life Insurance Policy

- Office of Southern/Northern Cultural Communities

- Birth/Baptismal certificate of child/ren

- Certificate of Licensure/Qualification Documents/Seafarer’s ID and Record Book from Maritime Industry

- Certificate of Naturalization from the Bureau of Immigration

- Seafarer’s Registration Certificate issued by POEA

- Bank Account Passbook

- Pag-IBIG Member’s Data Form

- Overseas Worker Welfare Administration card

- Police Clearance

- Marriage Contract

Do you want to know how much you may borrow under the offer? Feel free to visit – SSS Salary Loan Amount: Guide on How Much You May Borrow.

With regards to the SSS Salary Loan payment schedule, it actually varies if you are a regular or household employee or a self-employed or voluntary member of the state institution.

For member-borrowers who are employed as a regular employee of a company or institution, the SSS Salary Loan payment schedule would further depend on the “10th digit of the 13-digit ER/HR number”. Here’s the basis:

If it ends in…

- 1 or 2 – 10th Day of the Month

- 3 or 4 – 15th Day of the Month

- 5 or 6 – 20th Day of the Month

- 7 or 8 – 25Th Day of the Month

- 9 or 0 – Last Day of the Month

You may also visit – SSS Member Benefits: Full List of Benefit Offers for Qualified Members