Check the SSS Contribution Table 2024 for Non-Working Spouse Members in PH

SSS CONTRIBUTION TABLE 2024 – Here’s a guide on the monthly contributions set by the Social Security System for non-working spouse members.

In the Philippines, one of the biggest state-run social insurance agencies that you may apply for a membership is the Social Security System. It is more popularly called SSS and has been in the service of the Filipino people for decades now.

The SSS has a wide coverage with regards to the membership. It also has several offers such as loans and benefits which you can check below along with the contribution rates.

SSS Membership

In the Philippines, there are millions of Filipinos who are members of the Social Security System. They are individuals who are aged between 18 years old to 60 years old when they applied for a membership. Most of the members are under a compulsory membership while others are under a voluntary membership:

Compulsory Membership

- Employer (Business or Household Employer)

- Employee

- Self-Employed

- Househelper or Kasambahay

- Overseas Filipino Workers (OFW)

- land-based and sea-based including Filipino immigrants, permanent residents, and naturalized citizens of their host countries

Voluntary Membership

- Non-Working Spouse (NWS)

- Separated Members

SSS Loans & Benefits

The state-run social insurance agency got loan and benefit offers for its members. Its loans attend to several purposes and you can check the qualifications below set under each of the offers:

SSS Salary Loan

- employed / self-employed / voluntary SSS member

- at least 65 years old upon the loan application

- at least thirty-six (36) monthly contributions

- employer must be updated in posting the monthly contributions

- not a recipient of a final benefit such as retirement benefit

- no fraud case against the SSS

SSS Housing Loan

- member must have posted at least 36 monthly contributions with 24 continuous contributions prior to the application

- not more than 60 years old at the time of application

- not previously granted a repair and/or improvement loan by the SSS or NHMFC

- not been granted final SSS benefits

- borrower and spouse is updated in the payment of their other SSS loan(s)

SSS Calamity Loan

- member must have updated payment contributions and loan remittances

- has posted at least 36 monthly contributions with at least six (6) contributions posted within the last 12 months prior to the month of the filing of loan application

- residing in area declared under a State of Calamity

- has not received a final benefit from the Social Security System

- has no outstanding restructured loan under the SSS

Aside from the loan offers state above, the Social Security System also have benefit offers that members may apply for during certain circumstances. Here is a guide for the members on the requirements under each offer:

- SSS Sickness Benefit Requirements 2024

- SSS Unemployment Benefit Requirements 2024

- SSS Disability Benefit Requirements 2024

- SSS Maternity Benefit Requirements 2024

- SSS Retirement Benefit Requirements 2024

- SSS Death Benefit Requirements 2024

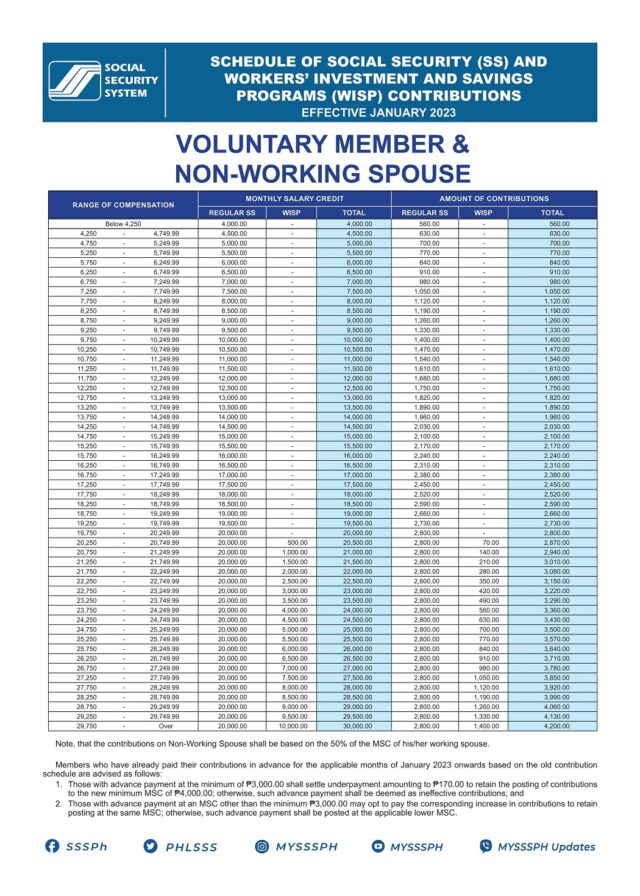

SSS Contribution Table 2024

Not only the employed individuals or those who have direct source of income may apply for an SSS membership. It is also open for the non-working spouse of an SSS member and here is the SSS contribution table 2024 for the non-working spouses of the SSS members: