List of UnionBank Loan Fees & Charges Under the Home Loan

UNIONBANK LOAN FEES – Here is a list of the fees and charges under the UnionBank Philippines’ Home Loan offer.

Are you one of those people who wanted to acquire a house but cannot pay for it in full yet? There are several solutions to that now and you can achieve your dream house in just a few steps. Banks like the UnionBank Philippines got home loan offers for the public.

You may apply for the UnionBank Home Loan to fund the purchase of a lot, a house and lot, a condominium unit, or a townhouse. The applicant must be:

- employed with a permanent work status (for employed applicants)

- owning a business that is profitable for at least two(2) years (for self-employed applicants)

- of legal age but not more than 65 years old on the maturity date of the loan

- having a good credit standing

With regards to how much you can borrow under the UnionBank Home Loan, here are the minimum and maximum loanable amounts under this offer:

- Minimum Loanable Amount – Php 500,000.00

- Maximum Loanable Amount – Up to 90% of the selling price of property

The interest rates will depend on the fixing term of the loan. For locally employed borrowers, you may pay for the loan for up to twenty(20) years while overseas Filipino workers (OFWs) can pay for it for up to fifteen(15) years.

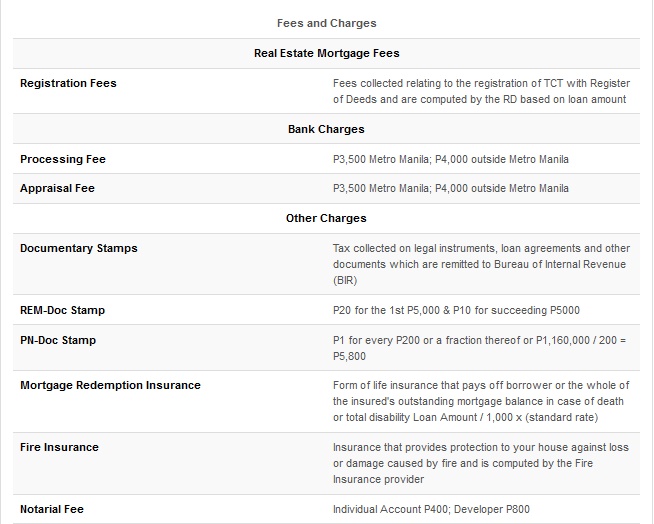

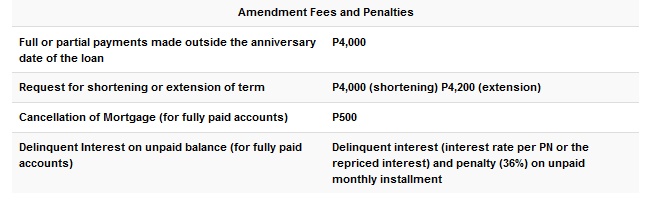

There are UnionBank loan fees and charges under the Home Loan offer. These include the registration fees, processing fee, appraisal fee, and as well as the insurance.

Here is a list of the UnionBank loan fees and charges under the Home Loan offer in courtesy of the bank:

Are you planning to apply for the said loan offer? You may visit – UNIONBANK HOME LOAN – How To Apply for Home Loan Offer of UnionBank.

Thank you for visiting our website. We hope we have helped you with regards to this matter. You may keep coming back for more informative guides.

READ ALSO: UNIONBANK LOANS – Full List of the Loan Offers of UnionBank