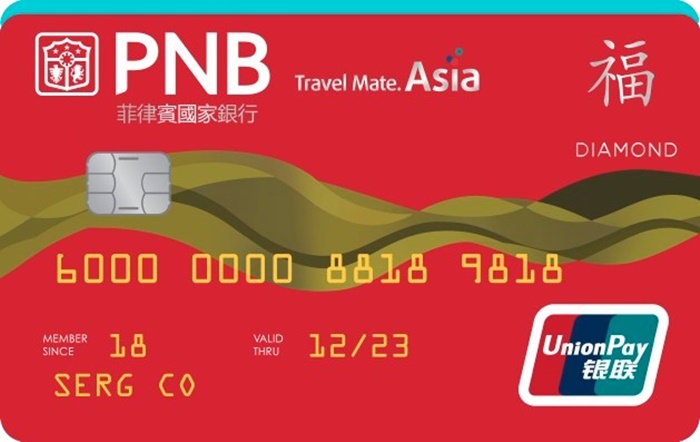

Guide on PNB Diamond UnionPay Credit Card Features & Requirements for Application

PNB DIAMOND UNIONPAY CREDIT CARD – Here are the features of this credit card offer of the Philippine National Bank or more commonly called PNB.

Are you looking for a credit card that can be your excellent buddy when traveling across asia? One of the credit card providers that you may turn to is the Philippine National Bank or more popularly called PNB.

The Philippine National Bank is one of the longest-running banks in the country. Previously, it was under the government but it was filly privatized in 2007. It has several offers including the different types of bank accounts as well as PNB loans and credit cards.

One of the credit card offers of the bank is the PNB Diamond UnionPay. It is a travel card that is packed with excellent features and benefits for the cardholders such as the following:

- earn rewards points for Cash Credits and Mabuhay Miles

- enjoy access to travel and medical concierge services to make things easier

- enjoy exclusive perks and privileges from UnionPay TravelMate Asia partner merchants

- boosted credit card security through the Card Protect feature

- widen the access to your credit card as you may apply for Supplementary Credit Cards for your loved ones FREE OF CHARGE

- access to single or dual currency billing

- enjoy wide acceptance across the globe

- contactless payment

With regards to the qualifications in applying for the PNB Diamond UnionPay Credit Card offer? Here are the eligibility requirements that a credit card applicant must meet in applying for the offer:

- at least 21 years old but not more than 65 years old at the time of the credit card application

- with an annual income of at least Php 120,000

The PNB Diamond UnionPay Credit Card offer is open not only for the employed and self-employed Filipinos but as well as foreign nationals. The bank has set varying requirements for application.

Here is a guide on the documents required by the Philippine National Bank in applying for the credit card offer:

Employed Filipinos

- latest one (1) month payslip or Certificate of Employment indicating the Gross Income, Date Hired, and Position or ITR or active principal credit card number with at least 1 year membership

- government-issued ID bearing photo and signature

- Proof of billing (any of the following):

- Utility Bills

- Credit Card Statement of Account

Self-Employed Filipinos

- Latest Income Tax Return with BIR Stamp and latest Audited Financial Statement

- government-issued ID bearing photo and signature

- Proof of billing (any of the following):

- Utility Bills

- Credit Card Statement of Account

Foreign National

Option 1

- Passport

- Alien Certificate of Residence (ACR)

- Proof of billing (for non-carded or non-depositor)

- Utility Bills (electricity, telephone, etc.) or Credit Card Statement of Account

- And any of the following:

- National ID

- Internal Revenue Service (IRS) ID

- Social Security Number (SSN) ID

- Driver’s License

- Work permit issued by DOLE (mandatory requirement) if employed in the Philippines

- Company ID issued by private entities or institutions registered with or supervised or regulated either by the BSP, SEC, or IC

Option 2

- Passport

- Unexpired Philippine Retirement Authority ID (PRA) or Special Resident Retiree’s Visa (SRRV)

- Proof of billing (for non-carded or non-depositor)

- Utility bills (electricity, telephone, etc.) or credit card statement of account

- And any of the following:

- Bureau of Immigration Approved Order

- Certificate of Deposit issued by the Bank where the PRA/Visa is deposited