Steps on How To Get TIN Number for Employees & the Requirements

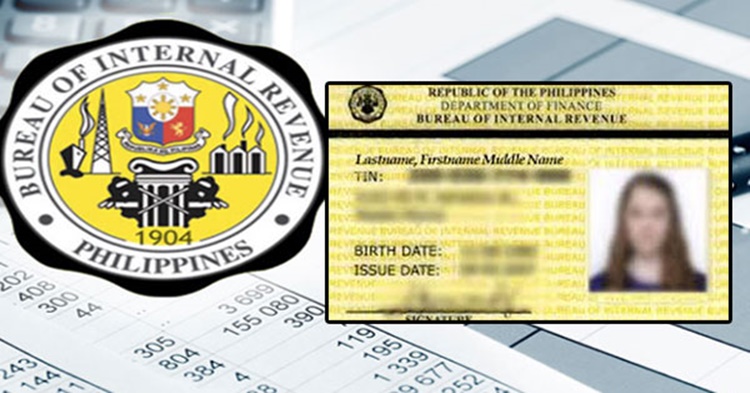

HOW TO GET TIN NUMBER FOR EMPLOYEES – Here is a complete guide in getting a Tax Identification Number from the Bureau of Internal Revenue or BIR.

In the Philippines, the government body that collects taxes is the Bureau of Internal Revenue or more popularly called BIR. It is also the body that issues the Tax Identification Number or more popularly called TIN to paying individuals and groups.

The Tax Identification Number is also issued even to unemployed individuals if there is a need for it like in the cases of paying for the capital gain tax. The Bureau of Internal Revenue has set a different list of requirements and steps in gettin a TIN or also popularly called TIN number.

The Bureau of Internal Revenue issues TIN number to the following:

- anyone who earns an income in the Philippines (Filipinos and foreign nationals)

- self-employed Filipino and foreign individuals including:

- freelancers

- sole proprietors

- online sellers

- professionals

- mixed-income earners

- local and foreign estates in the Philippines

- Filipino-owned and foreign-owned corporate tax payers in the Philippines

- persons registering under EO 98 to be able to transact with other government offices

- one-time taxpayers including the individuals who will be paying any of the following:

- capital gains tax

- donor’s tax

- estate tax

- tax on winnings

How to get TIN number for employees? There is an easy process. You just have to prepare the TIN Number requirements first including the payment of the TIN number fee.

Here are the steps on how to get a TIN number for employees:

- Step 1 — Provide all the information required in the BIR Form 1902.

- Step 2 — Submit your duly-accomplished BIR Form 1902 and the other documentary requirements to your employer. The employer will fill out the applicable sections in the form and file the TIN application to the RDO where the business is registered.

In the case of locally-employed individuals, the TIN must be applied for within 10 days from the hiring date.