Steps on Pag-IBIG Cash Loan Online Application 2024 for Members

PAG-IBIG CASH LOAN ONLINE APPLICATION 2024 – Here are the steps in applying for the multi-purpose loan offer via Virtual Pag-IBIG.

In the Philippines, if you are a Pag-IBIG Fund member, you have several loan offers that you can turn to in times of financial needs. Thus, there is a huge advantage in maintaining an updated account to the government office.

One of the Pag-IBIG loans that the members of the Fund may qualify for is the Multi-Purpose Loan offer. Also called MPL, this Pag-IBIG cash loan 2024 was designed to help meet the short-term financial needs of the member.

Who are qualified to apply for the loan offer? Here are the qualifications set by the bank for a member to be eligible for the loan application:

- has posted at least twenty-four (24) monthly membership savings under the Pag-IBIG Regular Savings program

- with active membership, by having at least one (1) monthly membership savings within the last six (6) months prior to the date of loan application

- if with an existing Pag-IBIG Housing Loan, MPL and/or Calamity Loan, the account/s must not be in default

- has a source of income

The Pag-IBIG loan offer can finance several purposes. It is the offer with the most flexible purpose as it can finance any of the following:

- Medical expenses;

- Minor home improvement;

- Capital for a small business;

- Tuition fee and other education-related expenses;

- Purchase of furniture, appliances or electronic gadgets;

- Payment of utility and credit card bills;

- Vacation and travel;

- Special events;

- Car repair; or

- Other needs

How much is loanable under the offer? There are no fixed Pag-IBIG cash loan loanable amounts but the Fund has posted the maximum range percentage. The basis includes the contributions of the members, his/her employer’s contributions, and the dividends earned.

The interest rate under the Pag-IBIG cash loan is implemented in an annual basis. The loan is payable for up to three (3) years.

You can go for a Pag-IBIG cash loan online application. This is most beneficial for members who are in need of a financial solution but cannot be absent from work to apply for the loan offer over-the-counter.

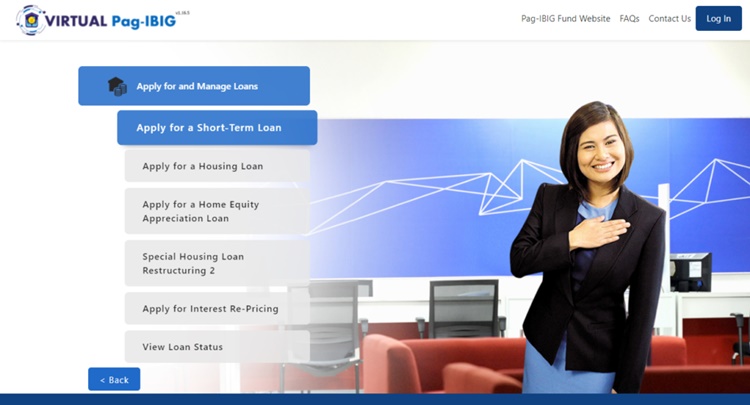

Here are the easy steps for the Pag-IBIG cash loan online application process:

- Step 1 — Go to Virtual Pag-IBIG. Log in to your account.

- Step 2 — Click or Tap “Apply for and Manage Loans”.

- Step 3 — Click or Tap “Multi-Purpose Loan”. Accomplish the form and upload scanned copies of your documentary requirements.

- Step 4 — Wait for an update from the Fund on the result of your loan application.

maam sir kanang akoa nga dugay nang wla nko nakatrabaho pwede ba nko nakuha ang sobra kng naa man gani og unsaon man

naa pakaha sobra sa akng pag ibig