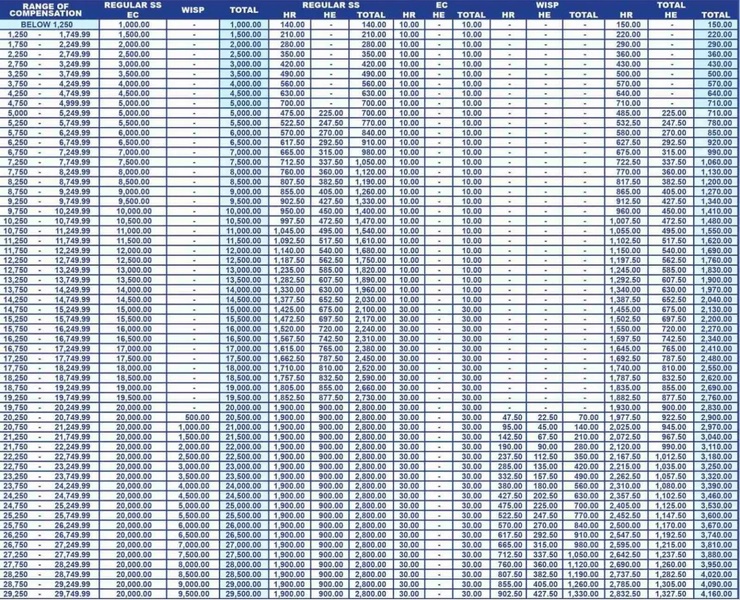

Here’s the SSS Contribution Table 2023 for Employer Members of the Insurance Institution

SSS CONTRIBUTION TABLE 2023 – Here is a guide for employers on their share of the SSS monthly contributions of their workers.

Many of the members of the Social Security System are individuals who are employed in the private sector. In this case, their employers pay for a share in the SSS contributions and you can check on the SSS Contribution Table 2023 below.

SSS Membership

The membership to the Social Security System (SSS) is open to a lot of people – individuals who are employed to the private sector, self-employed individuals, overseas Filipino workers (OFWs), non-working spouses of SSS members, and household helpers or kasambahays. The state-run social insurance institution has also opened its membership to those who want to apply for a voluntary membership to the agency.

SSS Monthly Contribution

A member of the SSS must pay a certain amount to the social insurance institution every month as contribution or savings. Accumulated savings can make a member eligible for the services offered by the social insurance institution including the Retirement Benefit, a monthly pension or lump sum, that most members are looking forward to.

SSS Member Benefits and Loans

Members of the Social Security System may be entitled to its benefit and loan offers. These services come with eligibility requirements that often include a limit on the monthly contributions posted by the member.

In most cases in companies in the private sector, the firms are the one which deduct the monthly contribution of their members and pay it to SSS.

SSS Contribution Table 2023

From time to time, there are changes on the monthly contributions of the SSS members as the rates may have increases. With regards to the SSS Contribution Table 2023, it has been released and there rates still vary depending on the increase as well as the amount earned by a member.

In the case of SSS members who are employees, their employers may have a share in their monthly contributions. Based on PhilPad, here is a guide for employers in private companies:

You may also visit – SSS Contribution 2023 – Here’s Full List of Updated Rates for Contributions to SSS this Year